what is a provisional tax code

Choosing the right account type. A provisional taxpayer is required to pay instalments of income tax called provisional tax during the income year rather than at the end of the year when a tax return is filed.

Income Tax Treatment of Social Security Benefits The income tax treatment of social security benefits is governed by section 86 of the Internal Revenue Code the Code.

. It requires the taxpayers to pay at least two amounts in advance during the year of assessment which are based on estimated taxable. If you are a provisional taxpayer it is important that you make adequate provisional. If your provisional tax paid is more than your RIT youll get a refund and may receive interest on the difference.

It is a method of paying the income tax liability in advance to ensure that the taxpayer does not have a large tax debt on assessment. It is a method of paying the income tax liability in advance to ensure that the taxpayer does not remain with a large tax debt on assessment. Incorrect use of tax code or rate for PAYE interest or dividends lump sum payments that did not have tax deducted or not enough tax deducted employee share scheme income that did not have tax deducted property sales subject to the bright-line property rule.

Thus the provision of the income tax for the accounting year ending on December 31 st 2018 for the company A ltd is 21000. A tax provision is just one type of provision that corporate finance departments set aside to cover a probable future expense. Your provisional income is your adjusted gross income plus half your Social Security benefits plus any tax-exempt income you received over the course of the tax year.

It requires the taxpayers to pay at least two amounts in advance during the year. This obligation to pay provisional tax can arise in addition to the taxpayers employer deducting tax from salary payments. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the relevant year of assessment.

Provisional rate or billing rate means a temporary indirect cost rate applicable to a specified period which is used for funding interim reimbursement and reporting indirect costs on awards pending the establishment of a final rate for the period. If you choose the ratio option for provisional tax youll pay in six instalments. What is Provisional assessment.

Provisional tax allows the tax liability to be spread over the relevant year of assessment. Assessment of tax made before it is possible to make a final assessment which is often based on for. Prior to 1983 social security benefits were not subject to income tax.

Provisional tax payers tax liabilities are based on an estimate of the amount of tax that will be payable by the taxpayer for the year. It requires the taxpayers to pay at least two amounts in advance during the year of assessment these are based on estimated taxable income. Provisional income calculations can get a bit complex though it is all laid out in 86 of the Internal Revenue Code IRC.

Now the calculation of the provision of the income tax will be as follows. Iii Provisional tax payments cannot be refunded or reallocated to different periods. Provisional tax is not a special separate type of tax but simply a mechanism to pay your taxes during the tax year instead of having a large amount due to SARS on assessment when you submit your Income Tax return ITR12.

Provisional tax is paid by individuals who earn income other than a salary traditional remuneration paid by an employer. Last operated tax code Provisional coding items Rounding up figures Take care and act promptly When is a secondary employment source record required Long tax codes S codes C codes. Iv Provisional tax payments cannot be allocated to different taxpayers.

Provisional income is an amount used to determine if social security benefits are taxable. Heres a list of the codes to use for different tax or account types. Other types of provisions a business typically accounts for include bad debts depreciation product.

An individual who has a child with a 50 Social Security benefit receives a temporary income level of about 5075 when he or she is born. There are some situations where you may need to pay provisional tax on your reportable income. If youve selected the ratio basis Xero calculates this for you.

Provisional rate or billing rate means a temporary indirect cost rate applicable to a specified period which is used for funding in- terim. Your provisional income is compared to certain thresholds to determine whether any of your Social Security benefits will be taxable at the federal level. When you file your income tax return and calculate your tax for the year you deduct the provisional tax you paid earlier.

Provision for Income tax 21000. Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year. 70000 30.

V The provisional tax payments together with any PAYE withheld during the year will be offset against the liability for normal tax at the end of the year of assessment. HM Revenue and Customs HMRC will tell them which code to. When you make a payment to us youll need to use your IRD number as reference as well as a payee code showing which type of tax the payment is for.

Provisional income is a threshold set by the IRS and Social Security benefits are taxed if they exceed the set amount. Provisional tax is not a separate tax. Provisional tax allows the tax liability to be spread over the relevant year of assessment.

It helps you calculate the provisional tax your organisation is to pay for the GST period youre running the report for. Your tax code is used by your employer or pension provider to work out how much Income Tax to take from your pay or pension. Child support Kiwisaver and tax pooling payments.

At the end of the year if a taxpayers actual tax liability exceeds the amount provisional tax paid he has to make. Several factors are assessed when calculating provisional income levels. Provisional tax is not a separate tax from income tax.

In the Internal Revenue Code86 specifies the basis for provisional income. Xeros provisional tax return is a worksheet for the provisional tax portion of the Inland Revenue IR GST and provisional tax return form. These can be due to.

Image Result For Gst Format Delivery Challan Invoicing Goods And Services Banking Institution

Social Security Benefits You Can Check Estimated Social Security Benefit Calculator Includ Social Security Benefits Disability Benefit Adjusted Gross Income

Italian Tax Code Codice Fiscale Studio Legale Metta

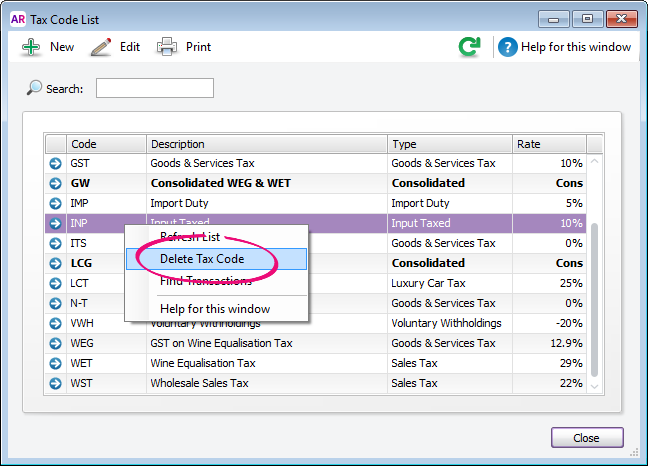

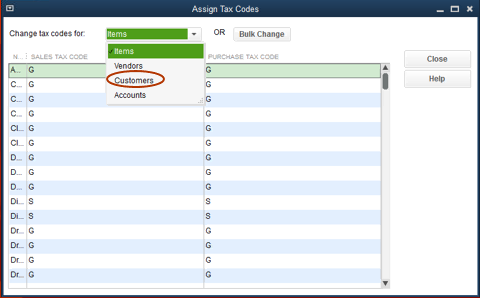

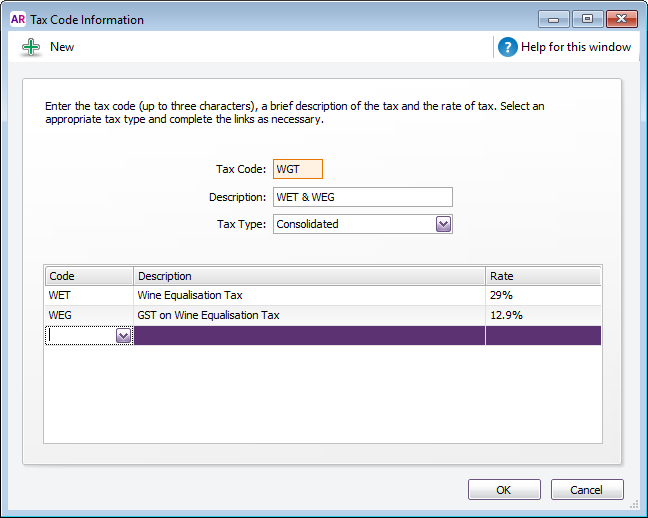

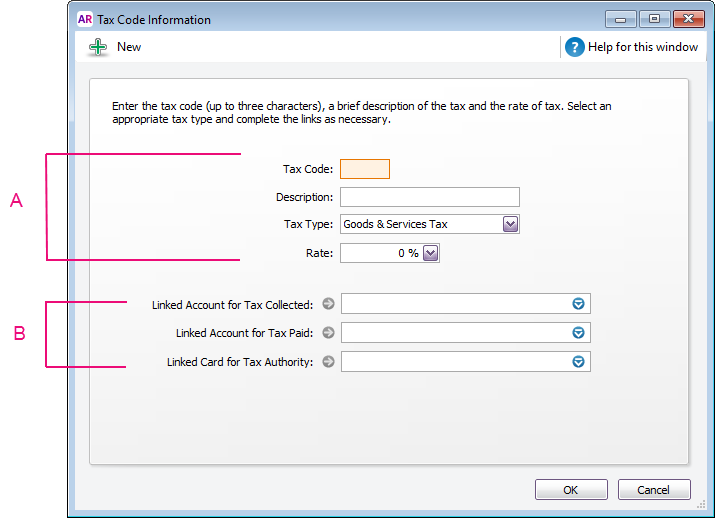

Setting Up Tax Codes Australia Myob Accountright Myob Help Centre

How To Set Up Sales Tax In Quickbooks Desktop

Pin By Swapna On Imp Lowercase Alphabet Lettering Lowercase A

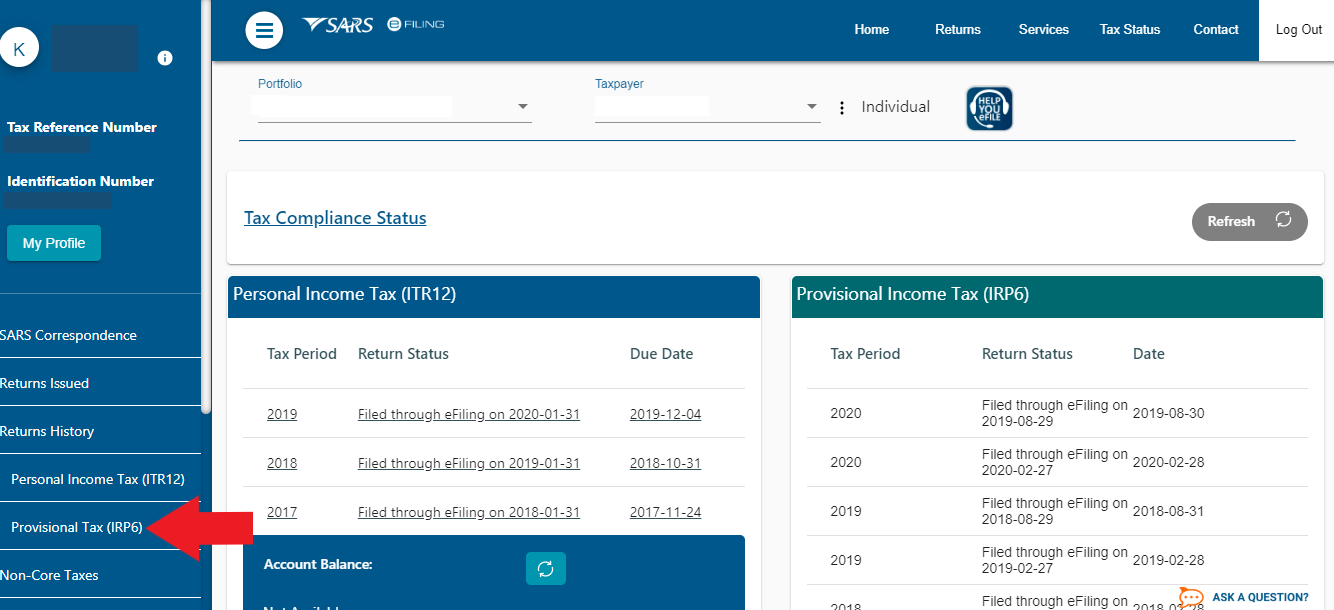

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Enrolment Of Central Excise Service Tax Vat Tot Entry Tax Luxury Tax Entertainment Tax Dealers On The Gst System Port System Goods And Service Tax Portal

Setting Up Tax Codes Australia Myob Accountright Myob Help Centre

Concept In 2021 Utility Patent Provisional Patent Application Concept

Pin By Swarit Advisors On Swarit Legal Advisors Research Skills Deduction Provisional Patent Application

Pin By Complypartner On Business Developed Economy Start Up Digital Marketing Services

15 Gst Faqs Replied By Official Twitter Handle Of Goi Question 1 Is It Compulsory To Put Hsn Code Wise Details In Twitter Handles Goods And Services Coding

Finding Your Way Around A Sars Irp5 Taxtim Blog Sa

Setting Up Tax Codes Australia Myob Accountright Myob Help Centre

Want To Get Latest Update News About Gst Like Latest Article Information And Much More Download The Mobile App For Android An Mobile App App Google Play Apps

How To Get The Italian Tax Code Codice Fiscale Yesmilano

Gst Registration Process Flow Chart Flow Chart Process Flow Chart Process Flow